Tangible assets are physical items that can be seen and touched. For example, vehicles, buildings, and equipment are tangible assets that you can depreciate. With the above information, use the amortization expense formula to find the journal entry amount.

Amortization Expense Journal Entry

Overall, companies use amortization to write down the balance of intangible assets and loans. Similarly, it allows them to spread out those balances over a period of time, allowing for revenues to match the related expense. Air and Space is a company that develops technologies for aviation industry. It holds numerous patents and copyrights for its inventions and innovations.

- However, it is a bit complicated as we will not credit assets balance directly.

- This can have serious consequences for a company’s financial health and reputation.

- To record a deferral, an accountant would debit an asset account and credit a revenue or expense account.

- Perhaps the biggest point of differentiation is that amortization expenses intangible assets while depreciation expenses tangible(physical) assets over their useful life.

What are some best practices for recording amortization expense?

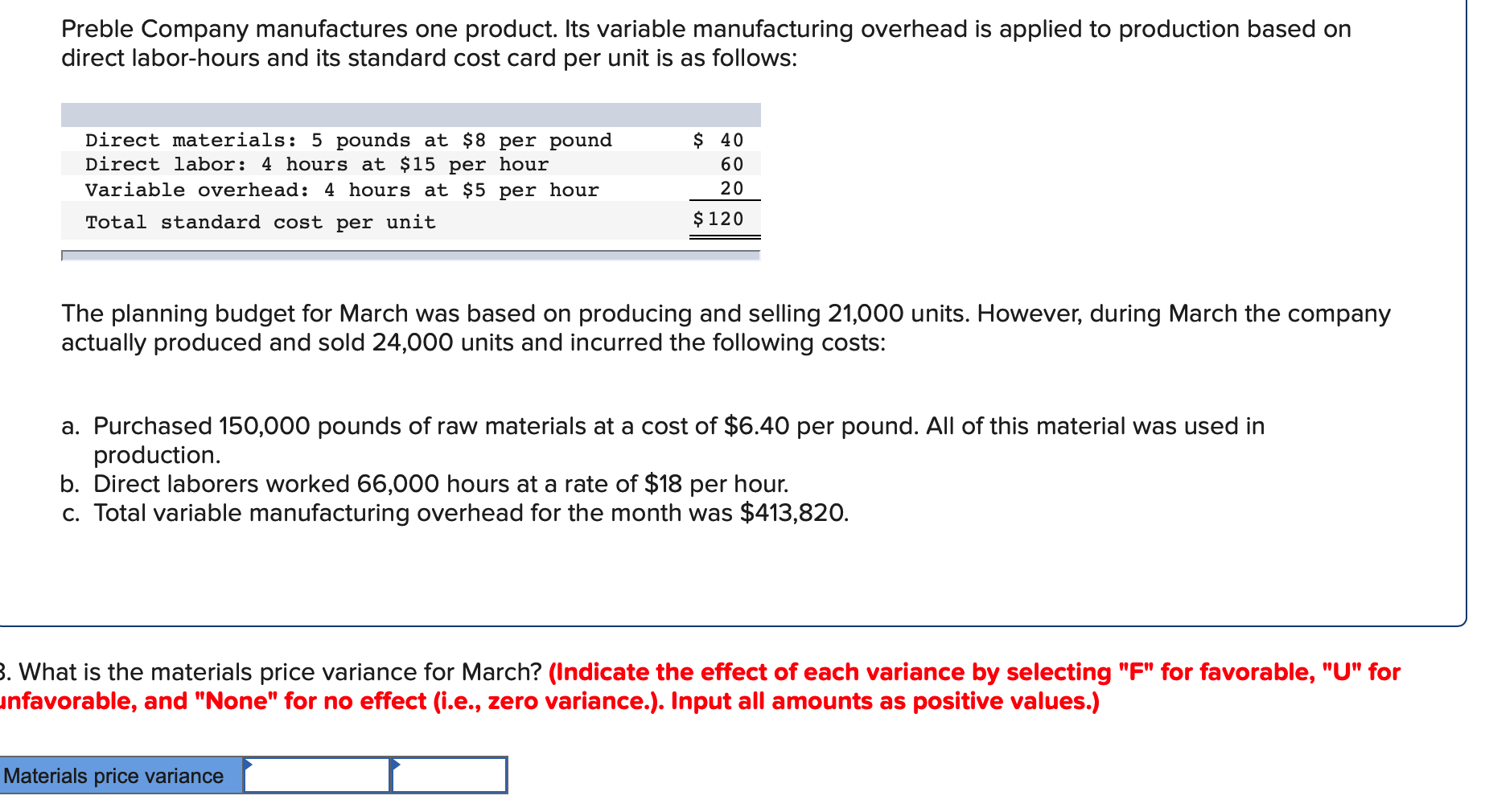

For example, cash can be taken from a bank account, and a false prepaid asset can be created to conceal the theft. As such, amortization schedules should be reconciled against other supporting documents to ensure accurate amortization expense recognition. Internal control over amortization expense is important for all stakeholders in a business. For example, cash can be taken from a bank account and a false prepaid asset can be created, to conceal the theft. The journal entry is debiting amortization expense of $ 10,000 and credit accumulated amortization of $ 10,000.

What is an Amortization Expense?

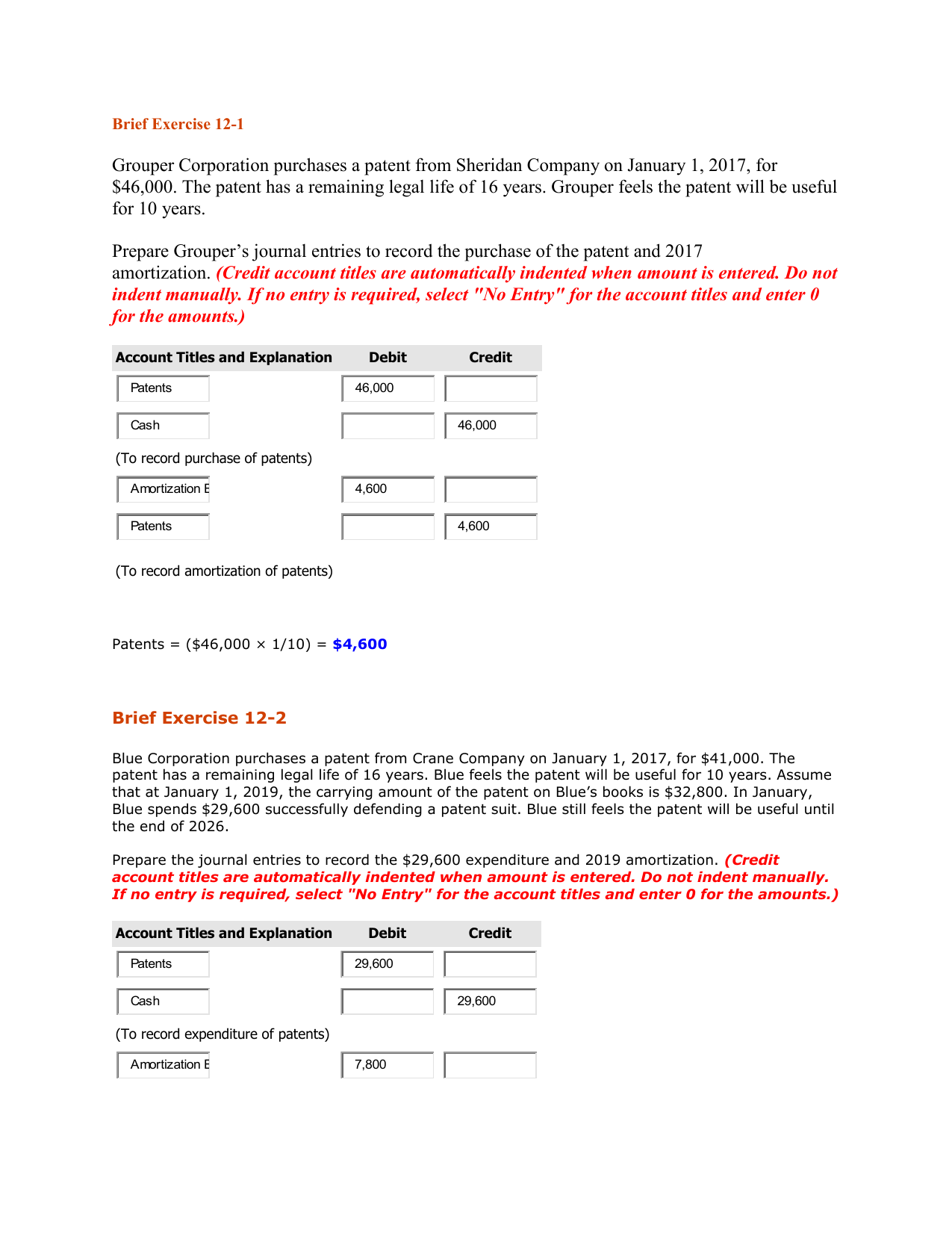

The schedule will consist of both interest and principal elements for the company to record. Amortization means spreading the cost of an intangible asset over its useful life. Suppose a company purchases a patent for 50,000 with a useful life of 5 years.

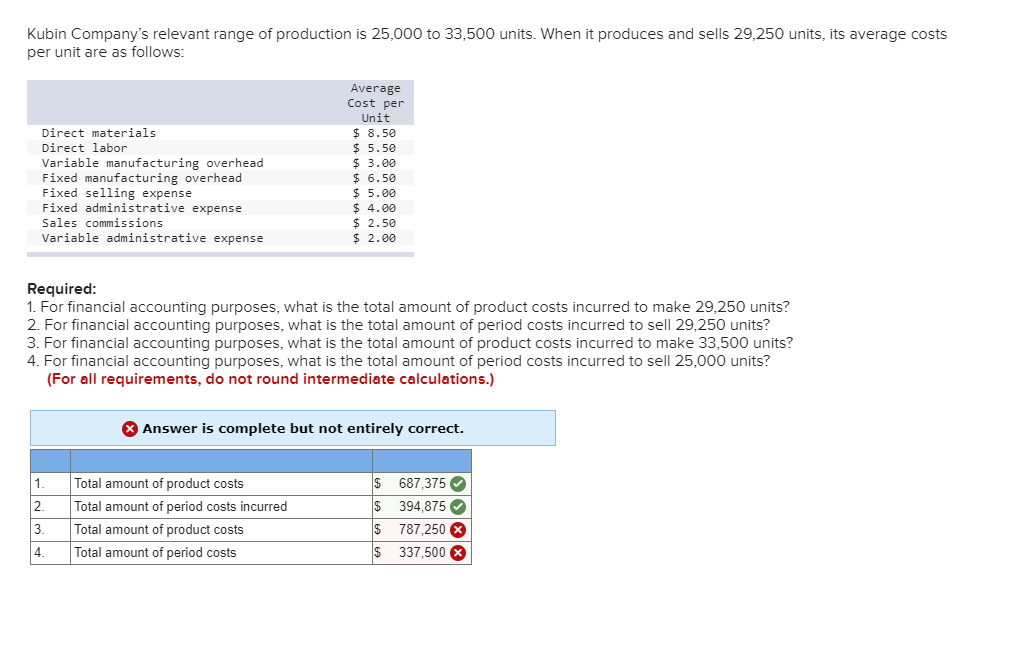

Amortization involves the systematic reduction of an account balance, such as prepaid expenses and capitalized loan costs, over a specified time. Simply stated, amortization is the process of reducing an amount such as a loan balance for a mortgage or auto loan by making monthly payments. In accounting, amortization tables or amortization calculators are used as support for journal entries and reconciliations that involve which journal entry records the amortization of an expense annual amortization expense. However, metrics such as EBITDA – earnings before interest, taxes, depreciation and amortization – exclude amortization to get a true sense of operational profitability. Adjustment entries are crucial in ensuring that financial statements accurately reflect the financial position of a company. Amortization is the allocation of the cost of an intangible asset over its useful life.

Entry Using Accumulated Amortization Account

The amortization expense increases the overall expenses of the company for the accounting period. On the other hand, the accumulated amortization results in a decrease in the intangible asset value in the Balance Sheet. Adjusting entries are necessary to ensure that financial statements accurately reflect a company’s financial position. These entries are made at the end of an accounting period to record transactions that have occurred but have not yet been recorded.

The accrual basis of accounting recognizes revenue and expenses when they are earned or incurred, regardless of when payment is received or made. Adjustment entries are necessary to ensure that all revenue and expenses are recorded in the correct period, even if payment has not been made or received. In the balance sheet, adjustment entries are used to update the values of assets and liabilities. For example, if a company has an account receivable that is unlikely to be collected, an adjustment entry is made to reduce the value of the asset. Similarly, if a company has a liability that has increased in value, an adjustment entry is made to reflect this change. Accruals are expenses that have been incurred but not yet paid.

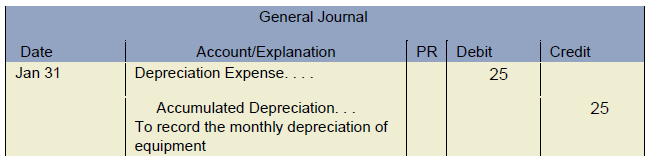

When amortization is charged, it is shown on the debit side of the income statement as an expense. This means some value of the intangible asset was used in the current accounting period, and the value was therefore reduced. Adjustment entries are made at the end of an accounting period, which can impact the timing of when revenue and expenses are recorded. For example, if an adjustment entry is made to defer revenue to a future accounting period, this will delay the recognition of revenue until the future period. Depreciation is the allocation of the cost of a long-term asset over its useful life. To record depreciation, an adjusting entry is made to decrease the asset account and increase the corresponding depreciation expense account.

For companies to record amortization expenses, it is necessary to have some specific amounts. Firstly, companies must have the asset’s cost or its carrying value recognized based on the related standards. Adjusting entries affect financial statements by ensuring that they accurately reflect a company’s financial position.