The Aviatrix slot game by Aviatrix is making waves in the UK online casino scene‚ captivating players with its unique aviation theme and dynamic gameplay. If you’re a fan of thrilling casino slots and seeking the best platforms to enjoy Aviatrix‚ this guide will direct you to the top online casinos where you can fully experience this game.

Top UK Casinos for Aviatrix Slot

Aviatrix slot’s blend of engaging visuals and rewarding features can be best enjoyed on reputable UK-licensed casino sites. Here are the premier options:

- Royal Ace Casino – Known for a sleek interface and reliable payouts‚ Royal Ace has quickly become a hotspot for Aviatrix enthusiasts.

- Spin Palace – Combining excellent mobile compatibility with attractive bonuses‚ Spin Palace offers a seamless Aviatrix playing experience.

- Betway – One of the giants in UK gambling‚ Betway’s collection includes Aviatrix with top-notch customer support and solid security.

- 888 Casino – Featuring high-quality graphics and smooth gameplay‚ 888 Casino is a strong contender for Aviatrix players.

General Rules of Aviatrix Slot

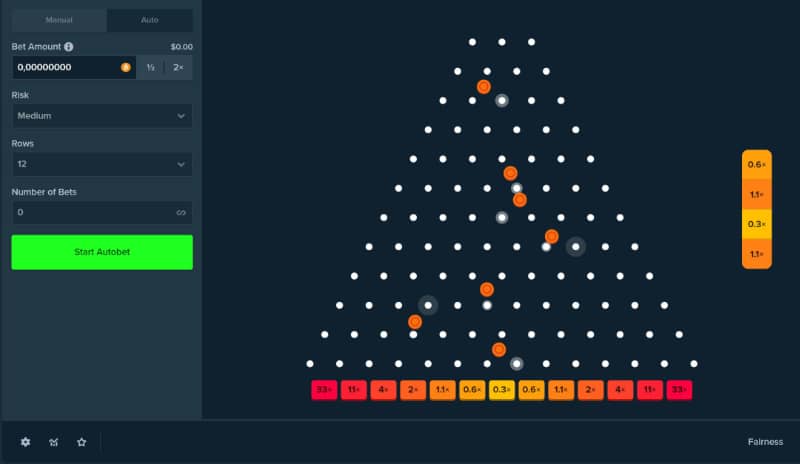

Understanding the mechanics of Aviatrix can enhance your experience when playing it in these casinos. Here are the basics:

- Reels and Paylines: Aviatrix features 5 reels with multiple paylines‚ allowing numerous chances to win on every spin.

- Symbols: The game includes thematic symbols such as pilots‚ planes‚ and aviator gadgets. Special symbols like Scatters and Wilds unlock bonuses.

- Bonus Features: Aviatrix offers free spins and multipliers activated through specific scatter combinations‚ intensifying your winning potential.

- Betting Range: You can place bets ranging from small stakes to higher amounts‚ ideal for cautious players and high rollers alike.

Interface and User Experience

Aviatrix’s user-friendly interface stands out for its simple navigation and immersive theme. Here’s what players enjoy most:

- Bright‚ clear graphics that render well on both desktop and mobile devices

- Easy-to-read control panels and betting options

- Smooth animations that enhance gameplay without causing lag

Frequently Asked Questions About Aviatrix

Q1: Can I try Aviatrix for free before playing with real money?

Yes‚ most UK online casinos offer a demo mode for Aviatrix‚ allowing players to explore the game without any financial risk.

Q2: What is the RTP (Return to Player) rate of Aviatrix?

Aviatrix boasts a competitive RTP of approximately 96.2%‚ which is favorable compared to many other slots in the market.

Q3: Is Aviatrix slot mobile-friendly?

Absolutely. The game’s design ensures seamless play on smartphones and tablets‚ making it perfect for gaming on the go. which UK casinos have aviatrix

Expert Feedback on Aviatrix

Player Who Won at This Slot

“I was thrilled when I hit the free spins round and managed to land several multipliers. The excitement of the aviation theme made the win even more rewarding!” – Sophie M.‚ UK

Casino Support Perspective

According to a support representative at one of the UK casinos offering Aviatrix‚ “Players appreciate the game’s balance of simplicity and engaging features. We’ve received praise for how smoothly Aviatrix runs across various platforms.”

Where to Play & Table of Recommended Casinos

| Casino | Bonus Offer | Mobile Friendly | Deposit Methods | License |

|---|---|---|---|---|

| Royal Ace Casino | 100% up to £200 + 50 Free Spins | Yes | Visa‚ Mastercard‚ PayPal | UK Gambling Commission |

| Spin Palace | Welcome Package up to £300 | Yes | Visa‚ Neteller‚ Skrill | UK Gambling Commission |

| Betway | Bet £10‚ Get £30 Free Play | Yes | Visa‚ Paysafecard‚ PayPal | UK Gambling Commission |

| 888 Casino | Up to £150 + 25 Free Spins | Yes | Visa‚ Mastercard‚ PayPal | UK Gambling Commission |

For UK players looking to take flight with an innovative and rewarding slot‚ Aviatrix by Aviatrix delivers on all fronts. Its availability on top UK casinos ensures a safe and exciting gambling session‚ whether you prefer desktop or mobile play. The combination of immersive themes‚ an intuitive interface‚ and generous gameplay features makes Aviatrix a must-try for both newcomers and seasoned slot lovers.

Get started today by choosing from the recommended casinos above‚ and see if you can soar to big wins with Aviatrix.