If you find yourself caught up indoors which have an instance out-of cabin temperature, among the better medicine is to find on the brand new open road-or perhaps the discover liquids. The new snap on the tresses, this new spraying on your own deal with, or the miles rolling out using your wheels? It is over recreation. Its therapeutic.

When the a car stands for independence and you can power, possessing a boat, cycle otherwise relaxation car (RV) presents liberty and spontaneity. If you’ve done your quest and made smartly chosen options regarding your loan, it means acquiring the antidote in order to persistence and fret best around on your own garage, out there anytime.

The choice to buy one will likely be certainly not natural, although not. There is lots to take on before you can to visit. Recreation auto tend to you need unique repair and repairs. You’ll want to think hidden costs such as for instance shops and you may licensing costs, insurance premiums and requisite jewelry.

After you decide this 1 suits you, the next thing is to shop to-not only to suit your the brand new vehicles, but for best Rv, motorboat otherwise bicycle financing. Before you could would, here are some items you should become aware of.

1. Borrowing unions will save you money

Did you know you could funds your own Rv that have OCCU? There are several reasons why you should https://paydayloansconnecticut.com/danielson/ get the loan because of a card commitment.

While the a not-for-money, we purchase towards all the way down costs and you can interest levels in regards to our participants. Even a tiny reduction of your interest adds up in order to hundreds of dollars during the savings along the life of an effective car loan. Listed below are some our loan calculator observe the difference on your own.

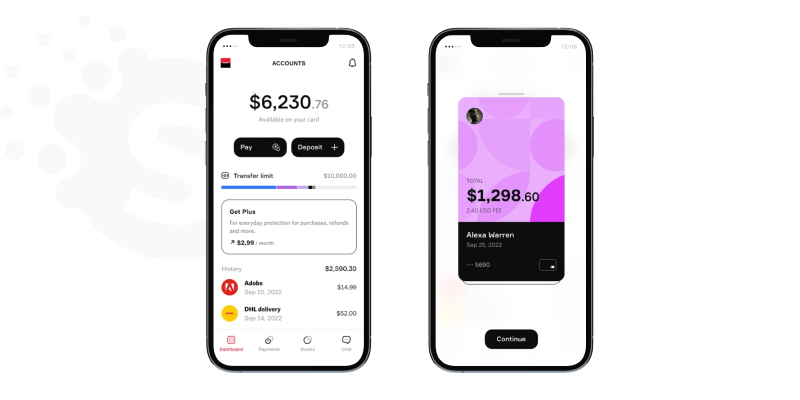

We including allow an easy task to stay on best of your own mortgage money. Having money regarding OCCU, you might manage your loan right from their MyOCCU On the internet Cellular account.

dos. Preapproval try strengthening

Among the smartest things you can do as a purchaser is rating preapproved to have an Rv, bike or vessel mortgage just before going feet in the a car dealership. With your preapproval available, you’ll know just how much you can afford to invest rather than overextending your financial budget. You will additionally enter a better reputation to discuss the proper rates for the pick.

step three. To shop for from a dealership

Make use of OCCU preapproval to order and you can complete the investment proper during the dealership. OCCU people having various Camper, motorboat, and you may motorsport dealerships throughout Oregon, Washington, and you can Idaho; merely come across the latest CUDL icon otherwise pose a question to your broker in the event that they are a good CUDL broker. In that case, you are able to the OCCU preapproval accomplish the whole transaction in one go. You could begin going to all of our OCCU specialist partners by going to this web page.

4. Years things

To purchase a preowned vehicle can also be hit several thousand dollars off of the car or truck, it cannot constantly save you money in the end. Decades and you may mileage is also each other impact the interest on your motorcycle, motorboat otherwise Rv mortgage. Because annual percentage rate may be higher towards older vehicles and you will vessels, make sure you determine the complete rates (which have notice provided) before deciding. Or talk to your loan officer from the and therefore solution could save you the extremely currency.

5. Your credit rating can present you with a boost

Once you purchase an auto, your credit rating will find what type of mortgage you happen to be eligible for, exactly how much you might acquire and you will exacltly what the interest will end up being. An identical is true with a boat, bicycle or Camper mortgage. The greater you can boost your credit rating before you apply, the greater you could potentially save well on desire.

6. There could be an income tax break in they for your requirements

We’re not right here to grant taxation recommendations, however, i manage suggest asking your own taxation top-notch in case your motorboat otherwise Rv you are going to qualify as the a second domestic, possibly making you federal income tax vacation trips according to your loan notice. Request a taxation agent to learn more.

You cannot set an expense with the leisure and you can stress relief, but you can save money on their Camper, bicycle otherwise vessel loan. Speak about our recreational automobile financing options to learn more about how OCCU can help you escape and you will discuss this new urban centers.