The whole process of buying your basic family is challenging and you can expensive, and it’ll likely include of a lot economic activities you’ve never discovered. Thankfully, the government and Fl county governing bodies keeps stepped in and you will created applications especially for very first-day home buyers. Even though you don’t possess far to get towards the an all the way down commission, or you need a decreased-rate of interest, these types of money and financial applications are great possibilities that will be value looking at. To invest in property is a significant step for everyone and it’s important to make sure that your cash come into purchase. Consider handling a monetary mentor to help make a propose to satisfy their long-name monetary requirements.

Just before i dive toward applications which might be particularly for Fl people, let’s learn an introduction to national home consumer applications that homeowners in any county have access to, as well as Fl. It seems sensible to take on one another state and federal possibilities when searching for the right home loan and often government choices are used given that the fresh new applications meet the requirements of several of people.

step 1. FHA Financing

This new Government Property Management of your U. Such mortgage loans are a fantastic selection for somebody looking to purchase an initial family. This is because possible just need to put step three.5% of the latest house’s worth at the time of purchasepare it to a normal financing that requires a good 20% downpayment.

However, for so it cheer within its complete glory you really need to have a beneficial FICO credit score out of 580 or higher. If you don’t, you will end up required to generate a 10% deposit, hence still means a partial posting over a conventional mortgage. However, even with which credit history specifications, an FHA loan belongs to the course out of easier-to-score mortgages.

2. Va Money

The brand new Department of Veterans Factors makes sure Va financing, however, 3rd-group mortgage brokers in fact situation her or him. They were created to assist pros who have had enough month-to-month earnings to afford a home loan but not adequate offers to support a down-payment. Consequently, Va loans do not need whatever down payment, definition your new residence’s value will be entirely protected by the home loan. That is fundamentally impossible to replicate away from an effective Virtual assistant mortgage, therefore it is increasingly valuable regarding a proposition.

In most items, need a beneficial 620 FICOcredit history so you’re able to safer acceptance having a great Virtual assistant loan. Moreover, you need to pay a good Virtual assistant money percentage, that may assortment from step 1.25% so you can dos.4% of the home’s really worth depending on even in the event you select to pay a deposit.

Besides the money fee, you’ll find little most other extraneous will set you back to handle into a Virtual assistant loan. In fact, you will never have to pay the usually obligatory private mortgage insurance just like the regulators have a tendency to straight back one half your own risk. you will likely realize that the settlement costs could be lesser than simply antique or any other mortgages, that should help you coast up your finances throughout the quick label.

3. USDA Funds

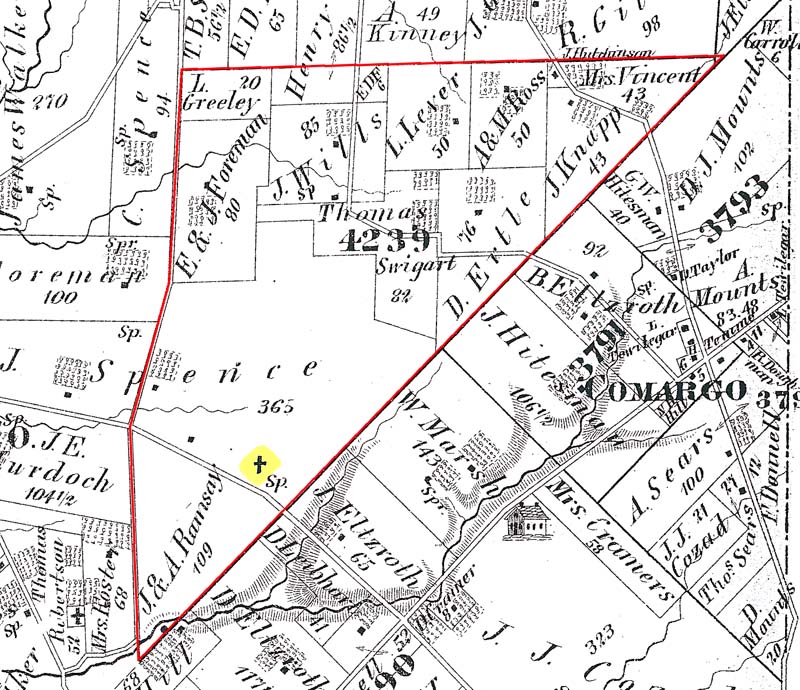

An effective United states Service from Farming otherwise USDA financing are lawfully labeled as good Part 502 Unmarried Nearest and dearest Construction Protected Financing Program. These mortgages are especially designed to appeal consumers to go to help you outlying (otherwise at the very least, semi-rural) regions of the nation. Only pick an individual-family home that’s approved by the USDA getting qualified to receive a loan, and you will be able to implement.

Possibly the most glamorous feature of mortgage would be the fact that it totally does away with dependence on an Gantt loans advance payment. Yet, if your credit rating falls a bit straight down towards the FICO spectrum, you might have to pay an advance payment of approximately 10%.